Let’s say your total sales for the year are expected to be $120,000, and you’ve found that in a typical year, you won’t collect 5% of accounts receivable. Accounts receivable are an asset account, representing money that your customers owe you. Automating your Accounts Receivable increases accuracy and efficiency, saving your business time and money while improving the customer experience.

Accountant And Office Manager

This can be from a purchase from a vendor on credit, or a subscription or installment payment that is due after goods or services have been received. All outstanding payments due to vendors are recorded in accounts payable. As a result, if anyone looks at the balance in accounts payable, they will see the total amount the business owes all of its vendors and short-term how to void a check lenders. Management can use AP to manipulate the company’s cash flow to a certain extent. For example, if management wants to increase cash reserves for a certain period, they can extend the time the business takes to pay all outstanding accounts in AP. A manager of finance accounting’s role is to oversee the financial activities in a company or organization.

Invoice Ninja

Tracking accounts receivable often involves using specialized software to monitor invoice statuses, payment due dates, and collections efforts. Accounts receivable turnover is calculated by dividing the net credit sales by the average accounts receivable during a specific period. As your business grows, automation allows your accounts receivable process to scale seamlessly. You can handle a larger volume of transactions without a proportional increase in manpower or resources.

Accounts receivable manager skills and personality traits

Good cash reconciliation can also improve a business’s customer relations. In the event of a dispute, having accurate records can back up your claims and help resolve disputes quickly and effectively. The following metrics are effective indicators for assessing how well a business runs its Accounts Receivable process. Tracking these metrics can help companies find areas to improve their assessment and collection processes. It’s a good practice to initiate dispute resolution promptly if any issues arise. This helps maintain positive customer relationships and increases the chances of invoice payment.

Be proactive about collecting payments

The main responsibilities for this role include managing invoices, handling missed payments and supervising Accounts Receivable Clerks. Our ideal candidate is familiar with all accounting procedures and can manage daily financial transactions end-to-end. If you have previous experience managing a financial team, we’d like to meet you.

Robust feature set includes thorough record-keeping, comprehensive reporting, excellent invoicing and inventory management, plus a capable mobile app. The Billtrust suite of AR solutions helps make sense of customers’ ever-expanding invoicing preferences, their growing use of digital payments, and AR teams’ valuable time. Accelerating the order-to-cash cycle benefits both sides of the B2B transaction. When the AP department receives the invoice, it records a $500 credit in accounts payable and a $500 debit to office supply expense.

Offers industry-specific features for consulting businesses, nonprofits, manufacturing companies, professional services and more. No third-party integrations, mileage tracking feature or ability to accept in-person card payments. Feature set includes an excellent mobile app and suite of reports, capable invoicing features, plus automated bill and receipt capture through Hubdoc.

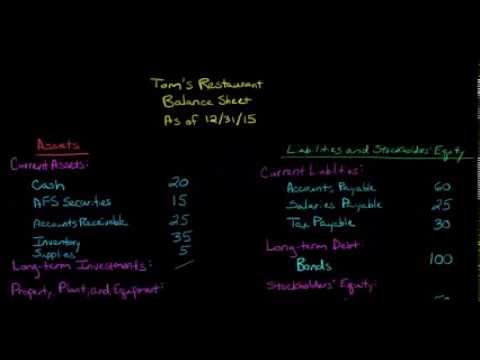

- Current asset less current liabilities equals working capital, and every business needs to generate enough in current assets to pay current liabilities.

- Many or all of the products featured here are from our partners who compensate us.

- Establishing a consistent invoice delivery schedule prompts customers to anticipate and prepare for on-time payments.

- For example, if management wants to increase cash reserves for a certain period, they can extend the time the business takes to pay all outstanding accounts in AP.

- Conversely, since you owe your accounts payable to your vendors and suppliers, accounts payable is a liability.

An accounts receivable workflow outlines the steps for managing customer invoices from issuance to payment and reconciliation. It often includes invoicing, https://www.simple-accounting.org/ collections, payment processing, and cash application. Accounts receivable is one of the most important line items on a company’s balance sheet.

Accounts receivable balances that will not be collected in cash should be reclassified to bad debt expense. You’ll lose some revenue with these payment terms, but you’ll collect some cash faster. For example, you may email every customer when https://www.personal-accounting.org/46-synonyms-and-antonyms-of-shares-out/ an invoice is later than 30 days, and call each client when an invoice is over 60 days old. If you enforce a policy, people will either start to pay you on time, or stop doing business with you (which may be fine, if they always pay late).

The appendices include various checklists, documents and the appropriate references to assist agencies in managing their credit and debt collection activities. A glossary of relevant terms is also included at the end of the document. Strong feature set includes thorough record-keeping, invoicing and advanced inventory management and pricing rules. With QuickBooks Enterprise, business owners can set up volume discounts and customize pricing rules according to sales rep, item category or customer in the Platinum plan and up.

The practice allows customers to avoid the hassle of physically making payments as each transaction occurs. In other cases, businesses routinely offer all of their clients the ability to pay after receiving the service. Furthermore, accounts receivable are current assets, meaning that the account balance is due from the debtor in one year or less. If a company has receivables, this means that it has made a sale on credit but has yet to collect the money from the purchaser.

You can start a timer from within the mobile app to log hours spent on a particular project or sync data from tools like Asana and Trello. Before joining NerdWallet in 2020, Sally was the editorial director at Fundera, where she built and led a team focused on small-business content and specializing in business financing. Our partners cannot pay us to guarantee favorable reviews of their products or services. Standalone AR products will usually support integrations with those systems. Tabs3 by ProfitSolv is a suite of integrated legal software solutions including fund accounting and accounts payable capabilities.

Again, using accounting software is the easiest way to ensure you reconcile these payments, since it gives your business a simple, automated way to track customer payments. A typical AR report shows how much revenue has been generated by invoicing clients for products or services. Accounts receivable are considered assets because they represent money owed to your business.